Are new one-year government bonds more interesting than term deposits offered by banks? We only know the overall coupon of 3 percent, and there is no definitive answer yet about the tax system. Whether a 15 or 30 percent withholding tax is imposed: Government bonds are almost impossible to beat. There is only one bank that does better with one-year term deposits than government bonds.

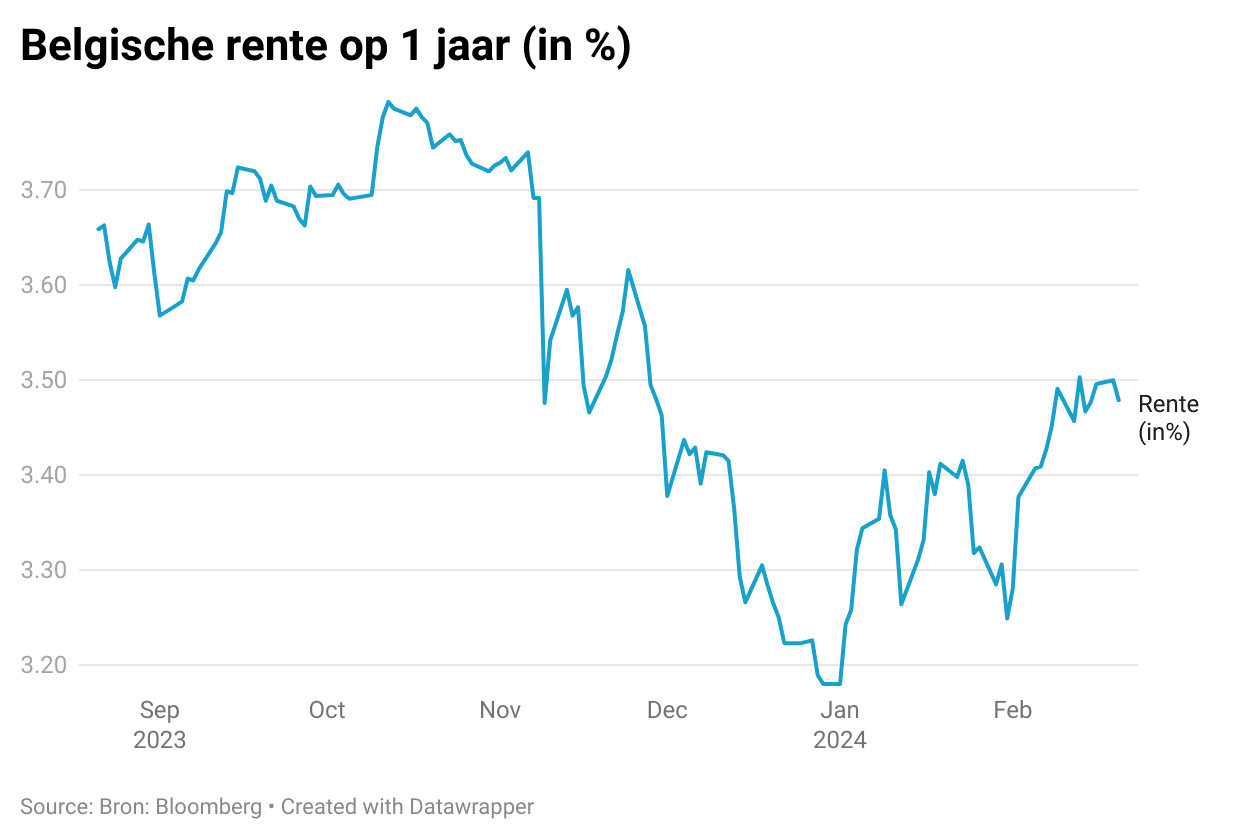

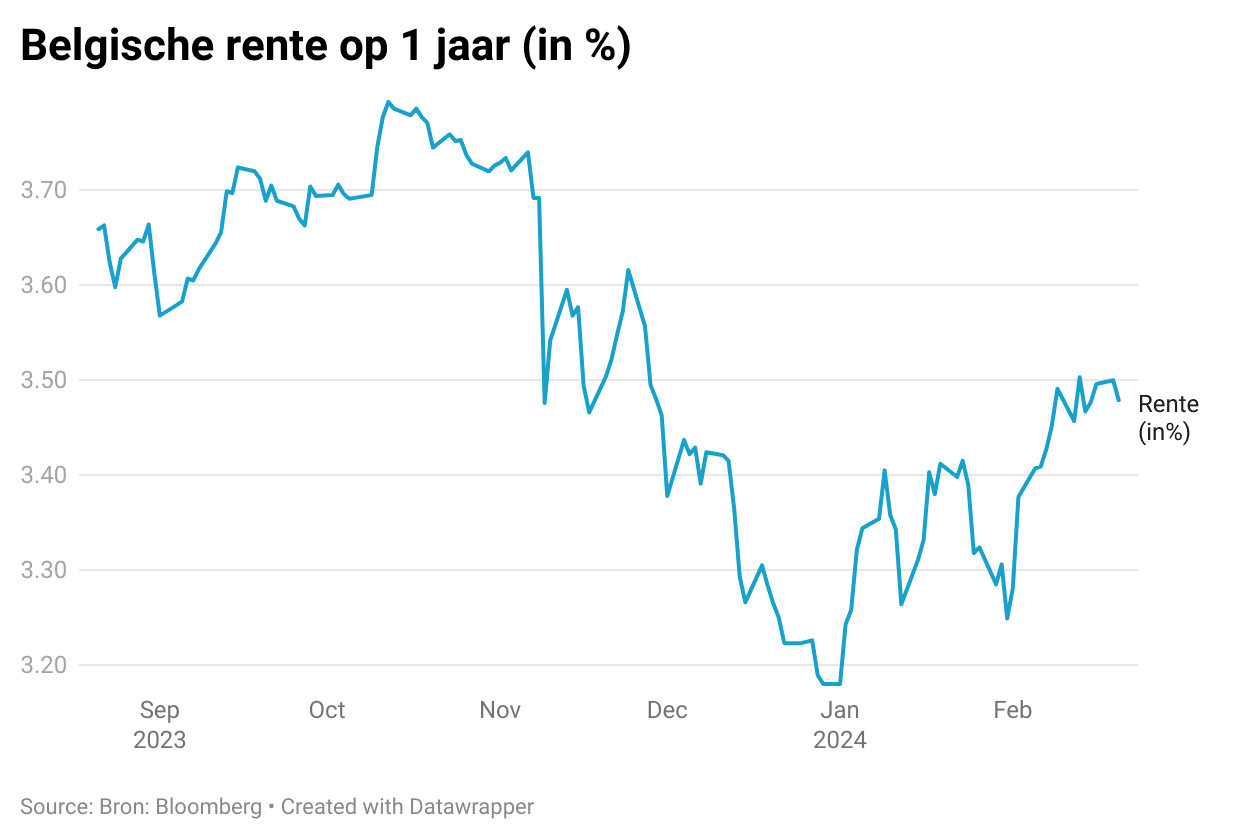

The debt agency set the total interest on government bonds at 3 percent. This is slightly lower than the 3.3 percent total achieved by government bonds in September. To this end, the agency considers the evolution of the Belgian interest rate over the course of a year. On August 22, when the interest rate for previous one-year government bonds was set, the Belgian one-year interest rate was still close to 3.7 percent. Today we are at just under 3.5 percent.

Read more below the video

“It would be strange for the government to give a tax deduction for its own product and discriminate against other savers who have a fixed-term account,” Prime Minister Alexander De Croo (Open Vld) said on Tuesday. the morning on Radio 1. “I see today that there are options for one-year accounts at much higher rates compared to previous months,” continued Prime Minister De Croo.

It is true that many banks have raised interest rates on term deposits in the past six months. Although there are also banks, such as NIBC, which have already announced their first interest rate cuts. This relates to expectations that the European Central Bank may implement its first interest rate cut this summer.

In September, during the issuance of the first one-year Belgian government bonds, several banks also ran a temporary promotion with high-interest accounts, to prevent too much savings from being depleted. NIBC was also on that list of banks. Consider this a short-term reaction by banks aiming to capture part of the €22 billion rush on government bonds.

Right now, we are not seeing a lot of movement in that area. Although this time there will be other banks that can offer higher interest rates on customer-style term accounts, when customers threaten to withdraw their money. MeDirect just announced that it will be distributing the government coupon for the first time and registered customers can get a 0.20 percent bonus, although the detailed terms of this promotion are not yet known.

One bank works best

If we look at current rates for one-year accounts, we can only conclude that new government bonds from March promise more interest. Whether those government bonds are subject to a 15 or 30 percent withholding tax: there is currently only one bank performing better. This is Isola Malta Bank, which operates as an Internet bank in our country. This is no coincidence, because the bank has a clear Belgian connection. It is owned by the Van Marke Group. Van Marcke is well known as a distributor of sanitary and central heating solutions.

Izola Bank offers 2.35 percent net interest on its one-year term deposit account. This is more than the net remaining 2.1 percent of the government bond coupon after deducting the regular withholding tax rate. With a 15 percent tax, the net interest on government bonds would be 2.55 percent. Isola is the only bank in Belgium that has announced a higher yield than government bonds without tax benefits.

There are some additional comments to be made. Although Isola Bank is active in our country, it operates under a Maltese license. Clients must also report the interest on their tax returns, and then must pay a 30 percent withholding tax. The Maltese government guarantees customer savings of up to €100,000. A minimum amount of €500 is required to subscribe to this term account. You can register for a €100 government voucher.

Deutsche Bank wants to put its foot in the door next to government bonds. The bank announced on Tuesday evening that it would offer the same amount “in terms of net return” on term accounts with shorter maturities than one-year government bonds. Deutsche Bank also distributes government bonds on behalf of the Belgian Debt Agency and does not charge custody fees for keeping the bonds in the bank's securities file.

Cat from the tree

For those who are not sure between a term deposit and new government bonds: know that there is a one-year registration limit for government bonds. Once €6 billion has been raised, registrations will close. It is reasonable for other banks to jump on the bandwagon and raise interest rates on term deposits in response. According to KBC, for every €1 billion that flows, €25 million of interest income goes to waste. KBC “will take appropriate business action,” KBC CEO Johan Theis said in an interview with Trends. This sounds promising, but as noted above, the initiative will likely come from the customer to request more attention.

Registrations in principle begin on Wednesday at midnight. While Finance Minister Vincent van Petegem initially promised a 15% reduction in withholding taxes, members of the government were quick to back away. It will likely become clear on Wednesday whether the total 3 percent coupon is subject to a 15 percent or 30 percent withholding tax. Although the chance of having a proper tax system seems to have been greatly reduced following the statements of the Prime Minister and other members of the government.

Read also:

“Coffee buff. Twitter fanatic. Tv practitioner. Social media advocate. Pop culture ninja.”

More Stories

Strong increase in gas export pipeline from Norway to Europe

George Louis Bouchez still puts Julie Tatton on the list.

Thai Air Force wants Swedish Gripen 39 fighter jets