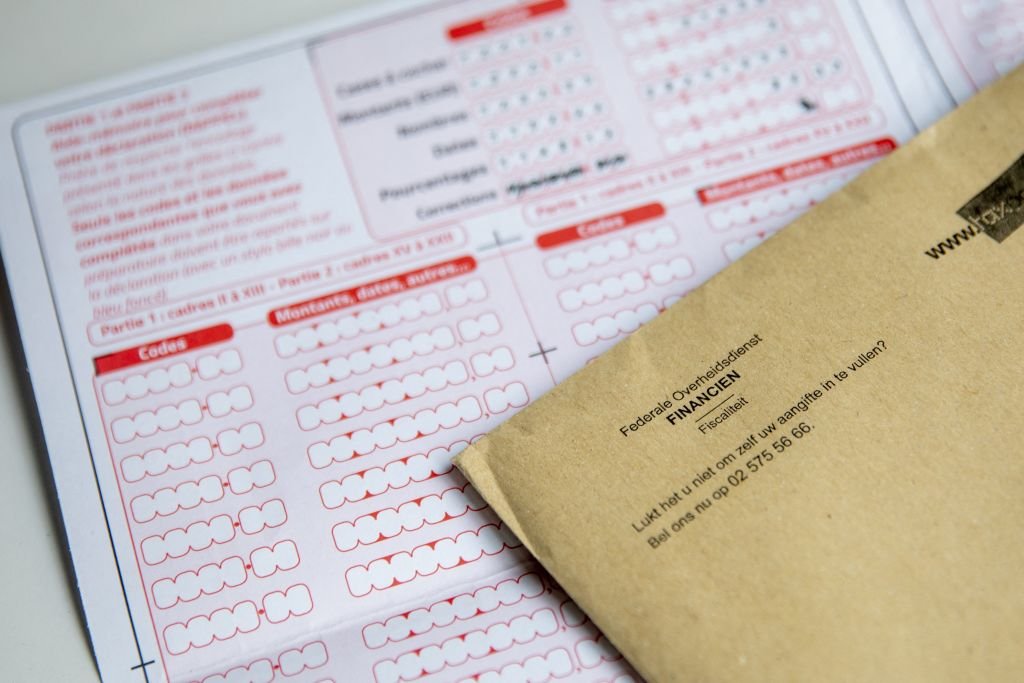

The world is going digital, and we also notice it when we meet our tax obligations. Anyone who wishes can obtain their tax return digitally. However, more than 260,000 taxpayers still choose the brown envelope. This option will disappear for companies in 2028.

In the news: A paper corporate tax return will remain in effect until 2028. After that, this option will disappear the time.

- The original goal was to eliminate paper tax returns for professionals next year. The government issued a law on this matter in 2021. It stipulates that all communications with people who have a company number must be digital from 2025, via eBox and MyMinfin. This includes tax returns, VAT returns and objections to proceedings. The government lifted the law last week, pushing the deadline to 2028.

- Individuals will also be able to submit their tax returns to the tax authorities via paper route after 2028.

- “This option will still exist for individuals – taxpayers who do not have a company number – who do not explicitly choose the digital route. Tax liabilities subject to personal income tax and non-resident tax must explicitly choose to communicate with the FPS digitally,” says Francis Adens, FPS spokesperson. Finance: “This principle has been preserved in the new law.” HLN.be.

- attention: Once you activate your eBox, FPS Finance assumes that you want to receive communications digitally only.

- notes Julie Leroy, a tax consultant in Unizo's research department the time Please note that FPS Finance still needs to clarify to entrepreneurs what matters are important and what does not fall within mandatory digital communications.

- “Since entrepreneurs are more likely to come first, there may be confusion between individual businesses. They file personal income tax versus their own, but their professional income is also included in the same tax return. So it still needs to be clarified what the tax authorities expect.” who are they”.

The majority choose digital tax returns

Some numbers: The majority of Belgian taxpayers already complete their tax returns digitally. However, there are still hundreds of thousands who prefer the classic way of working.

- The latest figures show that in 2022, 3,252,583 Belgians filed their personal tax returns via MyMinfin, while 264,173 people still file their tax returns on paper.

- If we look at companies, the difference is even greater. 467,957 filed corporate taxes electronically in 2022, while only 137 still do so on paper.

Do you want to stay up to date with everything happening in the financial world? Niels Silence, a journalist with a passion for finance, follows everything closely. during this link You can subscribe to his daily newsletter.

“Coffee buff. Twitter fanatic. Tv practitioner. Social media advocate. Pop culture ninja.”

More Stories

Strong increase in gas export pipeline from Norway to Europe

George Louis Bouchez still puts Julie Tatton on the list.

Thai Air Force wants Swedish Gripen 39 fighter jets