The United States accuses Switzerland and Vietnam of not artificially keeping their national currencies cheap. In December, when Donald Trump was president of the United States, both countries were branded as manipulators of exchange rates.

The U.S. Treasury Department now writes in its half-yearly report on trade partners’ monetary policy that Switzerland and Vietnam meet the criteria for currency falsification. Further investigation would have shown that there was no question of handling.

The United States continues to question whether the policies of its 20 largest trading partners are equivalent to handling exchange rates. Among other things, if a country buys a relatively large amount of foreign currency beyond a certain limit of trade surplus with the United States, it comes into the picture as a potential handler.

With the exception of Switzerland and Vietnam, Taiwan also met these criteria, but according to the Ministry of Finance, none of the three countries were guilty of manipulation. Washington also points to the devastating effect of the corona epidemic in 2020, which forced central banks and governments to support their own economies.

Surprise at the charge against Switzerland

The December indictment against Switzerland is astonishing. The Swiss franc is considered a safe haven for investors during crises. The Swiss central bank also firmly denied keeping the national currency artificially cheap.

According to critics, investigations into possible price manipulation under Trump have been politicized. For example, his government branded China as a manipulator of exchange rates in 2019, but the United States withdrew that accusation in early 2020 as part of a trade agreement.

The label of a handler does not immediately lead to severe restrictions on business partners. The law requires the US government to consult with countries accused of money laundering.

The United States also maintains a list of countries that are being closely monitored due to monetary policy. At the moment, China, Japan, South Korea, Germany, Ireland and Mexico are all under the magnifying glass.

“Introvert. Communicator. Tv fanatic. Typical coffee advocate. Proud music maven. Infuriatingly humble student.”

More Stories

Russian Tortoises: The Ideal Pet for Reptile Enthusiasts

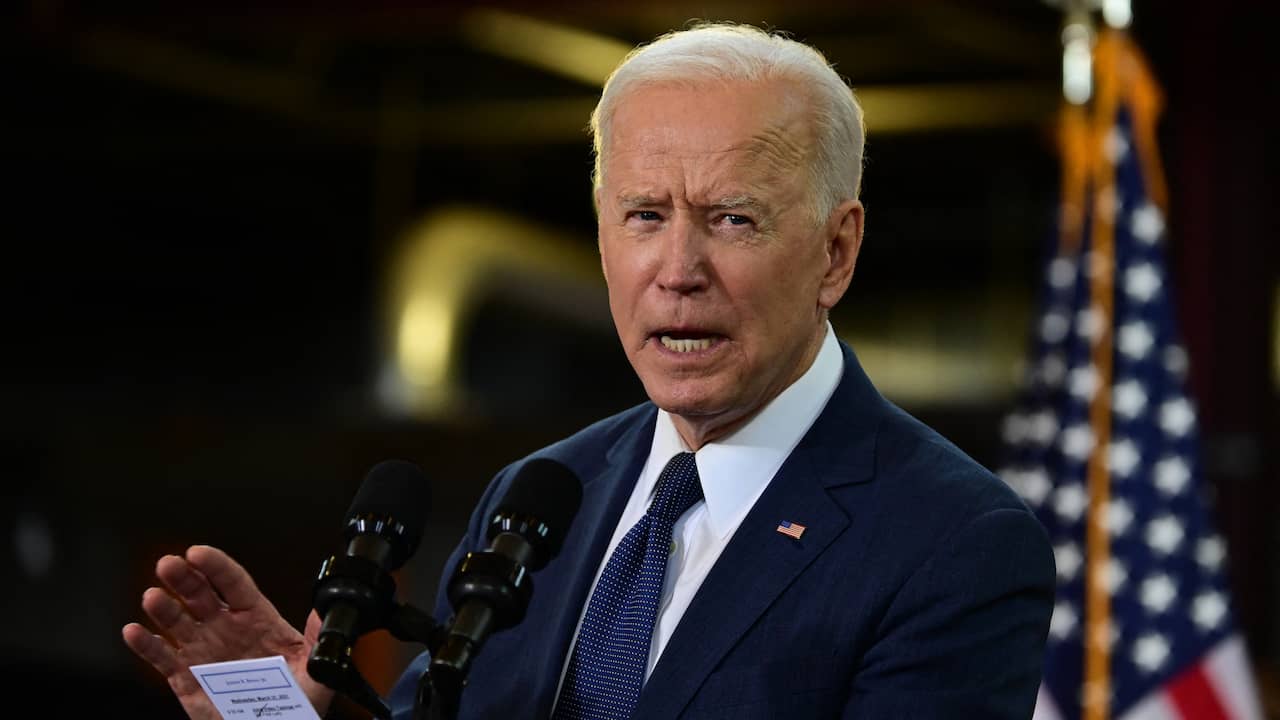

Biden and Xi want to sit down one last time

The United States won gold in the team relay on the opening day of the mountain bike world championships